san antonio local sales tax rate

The County sales tax rate is. The latest sales tax rate for San Antonio FL.

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Maintenance Operations MO and Debt Service.

. San Antonio collects the maximum legal local sales tax. There are approximately 3897 people living in the San Antonio area. The San Antonio sales tax rate is.

The minimum combined 2020 sales tax rate for San Antonio Texas is 825. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The San Antonio Sales Tax is collected by the merchant on all.

The December 2020 total local sales tax rate was. Real property tax on median home. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

San Antonio TX Sales Tax Rate. The December 2020 total local sales tax rate was also 6. The current total local sales tax rate in San Antonio FL is 7000.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Waco TX Sales Tax Rate. There are approximately 589 people living in the San Antonio area.

The minimum combined 2022 sales tax rate for Bexar County Texas is. Download all Texas sales tax rates by zip code. The Texas sales tax rate is currently.

The San Antonio New Mexico sales tax rate of 65 applies in the zip code 87832. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. San Antonio FL Sales Tax Rate.

2020 rates included for use while preparing your income tax deduction. The Bexar County sales tax rate is. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for San Antonio Texas is. Likewise people ask how much are taxes in San Antonio.

Has impacted many state nexus laws and sales tax. This includes the rates on the state county city and special levels. 2020 rates included for use while preparing your income tax deduction.

The San Antonio Mta Sales Tax is collected by the merchant on all qualifying sales made within San Antonio Mta. San Antonios current sales tax rate is 8250 and is distributed as follows. There is no applicable county tax.

This rate includes any state county city and local sales taxes. Local Governments Eminent Domain. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

Balcones Heights Crime Control. Texas Comptroller of Public Accounts. San Antonio has parts of it located within Bexar County and Comal County.

San Antonio Atd Transit. The minimum combined 2022 sales tax rate for San Antonio Florida is. The current total local sales tax rate in San Antonio Heights CA is 7750.

San Antonio TX Sales Tax Rate. Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. The current total local sales tax rate in San Antonio NM is 63750.

The Florida sales tax rate is currently. The December 2020 total local sales tax rate was also 7750. The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 San Antonio Mta local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc.

This is the total of state and county sales tax rates. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. San Antonio NM Sales Tax Rate.

Remember that zip code boundaries dont always match up with political boundaries like San Antonio or Pasco County so you shouldnt always rely on something as imprecise as zip codes to determine. Sales Tax State Local Sales Tax on Food. Download all Texas sales tax rates by zip code.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. It is based upon prevailing local real estate market conditions.

The minimum combined 2020 sales tax rate for San Antonio Texas is 825. Did South Dakota v. The Texas state sales tax rate is currently.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. Did South Dakota v. Bexar Co Es Dis No 12.

This rate includes any state county city and local sales taxes. Sales and Use Tax. City sales and use tax codes and rates.

The local sales tax rate in Bexar County is 0 and the maximum rate including Texas and city sales taxes is 825 as of June 2022. San Antonio Mta Transit. The 2018 United States Supreme Court decision in South Dakota v.

This is the total of state county and city sales tax rates. 1000 City of San Antonio. An alternative sales tax rate of 65 applies in the tax region Socorro which appertains to zip code 87832.

This is the. You can find more tax rates and allowances for. The latest sales tax rate for San Antonio NM.

Within San Antonio there are around 82 zip codes with the most populous zip code being 78245. The latest sales tax rate for San Antonio TX. The December 2020 total local sales tax rate was also 7.

The state sales tax rate in Texas is 6250. Texas has a statewide sales tax rate of 625 which has been in place since 1961Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with. 2020 rates included for use while preparing your income tax deduction.

San Antonio Sales Tax Rates for 2022. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. The property tax rate for the City of San Antonio consists of two components.

This rate includes any state county city and local sales taxes. This is the total of state county and city sales tax rates. If you make 55000 a year living in the region of Texas USA.

Does Texas have sales tax. The San Antonio sales tax rate is. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected.

What is the sales tax rate in San Antonio Florida. Texas has recent rate changes Thu Jul 01 2021. Sales Tax Rate Tax Jurisdiction.

The average cumulative sales tax rate in San Antonio Texas is 822. The current total local sales tax rate in San Antonio TX is 8250. With local taxes the total sales tax rate is between 6250 and 8250.

The County sales tax rate is. The San Antonio Florida sales tax rate of 7 applies in the zip code 33576. Wayfair Inc affect Texas.

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

Texas Sales Tax Rates By City County 2022

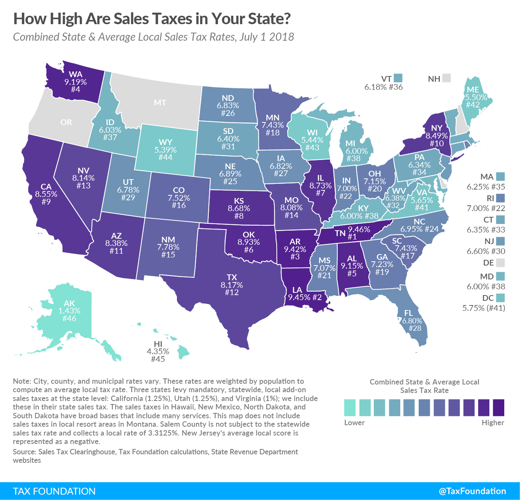

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

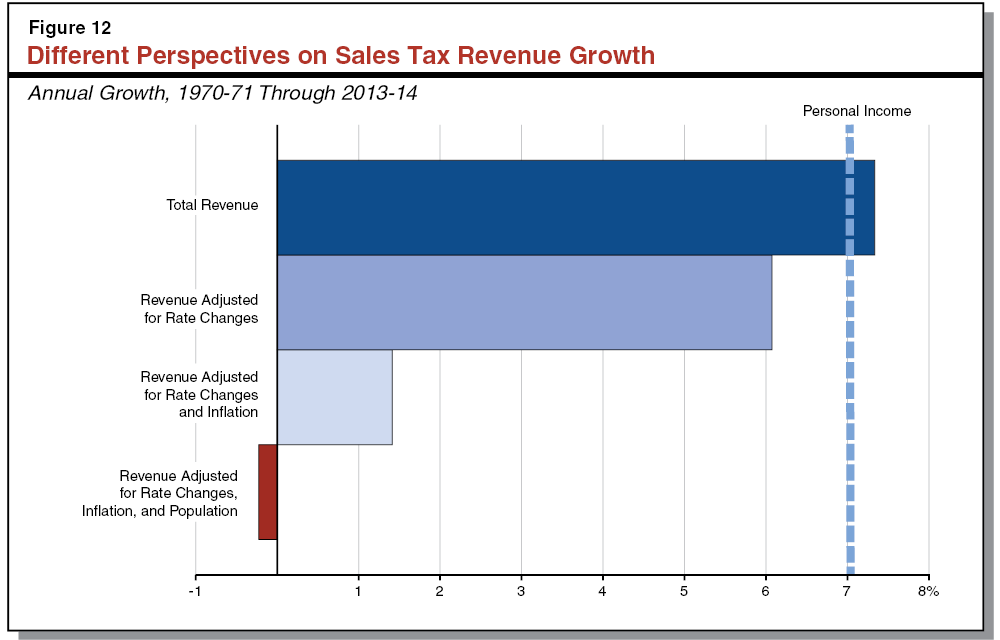

Understanding California S Sales Tax

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Understanding California S Sales Tax

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Texas Sales Tax Guide And Calculator 2022 Taxjar

Texas County Challenge Texas County Map Texas County Texas Map

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Albany Boosts Taxes On Wealthiest Wsj

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com

Understanding California S Sales Tax